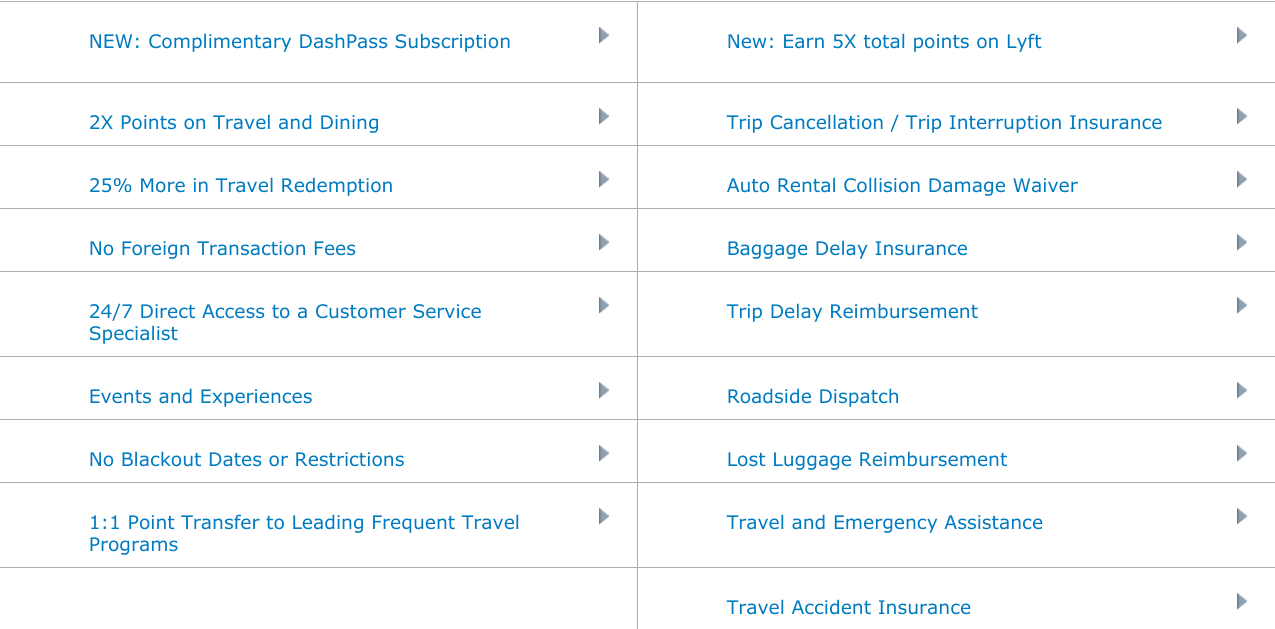

The insurance provides up to $10,000 per covered trip in reimbursement when problems happen, with a maximum limit of $20,000 per occurrence, and a $40,000 total maximum payout over a 12-month period. Covered reasons for interruption or cancellation include severe weather jury duty that can't be postponed a court order or subpoena that can't be postponed or injury, sickness, or death of the cardmember, an immediate family member, or a traveling companion. If you’re a Sapphire Preferred cardmember, you’re covered by this insurance, and your family is protected too. If your trip must be delayed for a covered reason and you incur fees, your trip interruption insurance will cover this as well. The same goes for trip interruption insurance - if something happens either on the way to departure or after leaving and you can't continue your vacation, you may be able to recoup all or part of your travel costs. If you book your trip and need to cancel it, trip cancellation insurance might cover the cost if you cancel for a covered reason. Trip cancellation or interruption insurance Below are some details about each type of coverage. You do have to make sure to follow Chase's requirements to make a claim, though, including immediately reporting your losses as soon as practical and providing proof of the damages you incurred. Coverage includes trip cancellation or interruption insurance, lost baggage insurance, travel accident insurance, and rental car insurance. With the Chase Sapphire Preferred, you can access many different kinds of insurance coverages that protect you wherever you travel. Then, input the details about your trip so you can use your Chase credit cards without worry while you’re traveling. To set a travel notification, simply sign into your account, go to "Account services," and choose "Travel notifications." Click "Add a trip," and confirm your identity by opting to receive a text notification or phone call. And if you’re planning to be away a while, you can set the duration of your trip for as long as 90 days. You can notify Chase of your impending trip up to a year in advance if you know the dates and like to plan ahead. You can avoid any problems using your card abroad by setting up a travel notification with Chase.

This could trigger a phone call and a freeze on your account until you confirm the spending is legitimate. Using your card in a different country certainly counts as unusual spending. Most credit cards, including the Chase Sapphire Preferred card, aim to protect you against fraudulent charges by watching for unusual activity. Check out our list of the best credit cards with no foreign transaction fees for more options. So if you spend $5,000 abroad and have to pay a 3% fee, you'd waste $150 in unnecessary fees that you won't have to worry about if you use your Sapphire Preferred card.

Many other credit cards charge a fee equal to a percentage of your purchases, commonly 3%. You won't have to pay foreign transaction feesĬhase Sapphire Preferred cardholders pay no foreign transaction fees on charges outside of the U.S.

0 kommentar(er)

0 kommentar(er)